FS KKR Capital Corp.

We seek to continue to build on the strong investment expertise and sourcing networks of KKR Credit and FS Investments, the joint operators of our investment adviser, and adhere to an investment approach that emphasizes strong fundamental credit analysis and rigorous portfolio monitoring. We intend to continue to be disciplined in selecting investments and focused on opportunities that we perceive offer favorable risk/reward characteristics and relative value. We believe the market for lending is currently characterized by significant demand for capital and that we will continue to have considerable opportunities as a provider of capital to achieve attractive pricing and terms on our investments.

Portfolio highlights

as of March 31, 2020 and based on fair value unless otherwise noted

184

Portfolio

companies1

22%

Concentration in top- 10 portfolio companies2

70%

Of investments in senior secured debt2

$64M / 5.6x

Median portfolio company EBITDA & Leverage

84%

Of debt investments are floating rate3

9.0%

Wtd. avg. annual yield on accruing debt investments4

3.9%

Non-accrual rate

93%

Lead, co-lead,

or sole lender5

1. Does not look through to FSK’s portfolio companies held solely in SCJV.

2. Figure excludes the impact of FSK’s investment in SCJV.

3. See FSK’s Quarterly Report on Form 10-Q for its definition of debt investments.

4. FSK’s weighted average annual yield on all debt investments was 7.9% as of March 31, 2020. See FSK’s Quarterly Report on Form 10-Q for additional information on the calculation of weighted average annual yield on accruing debt investments and weighted average annual yield on all debt investments.

5. Figure based on count of Direct Origination investments only.

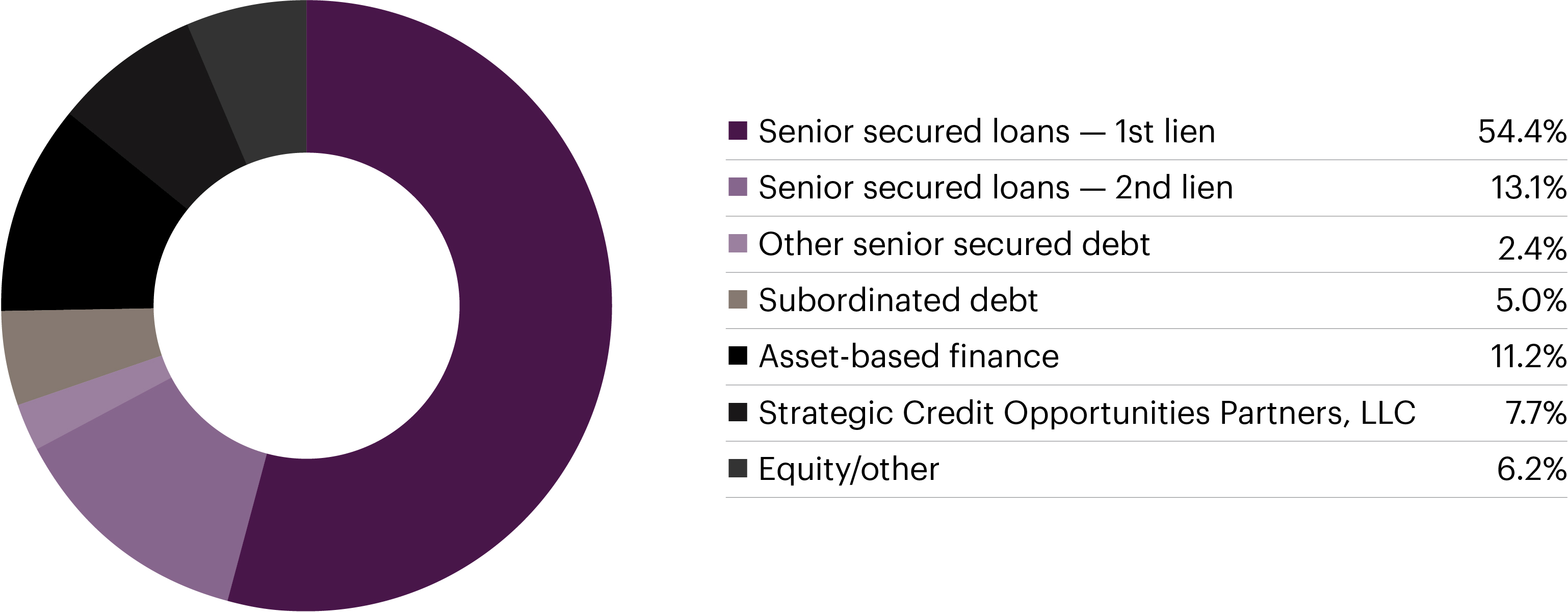

Security exposure

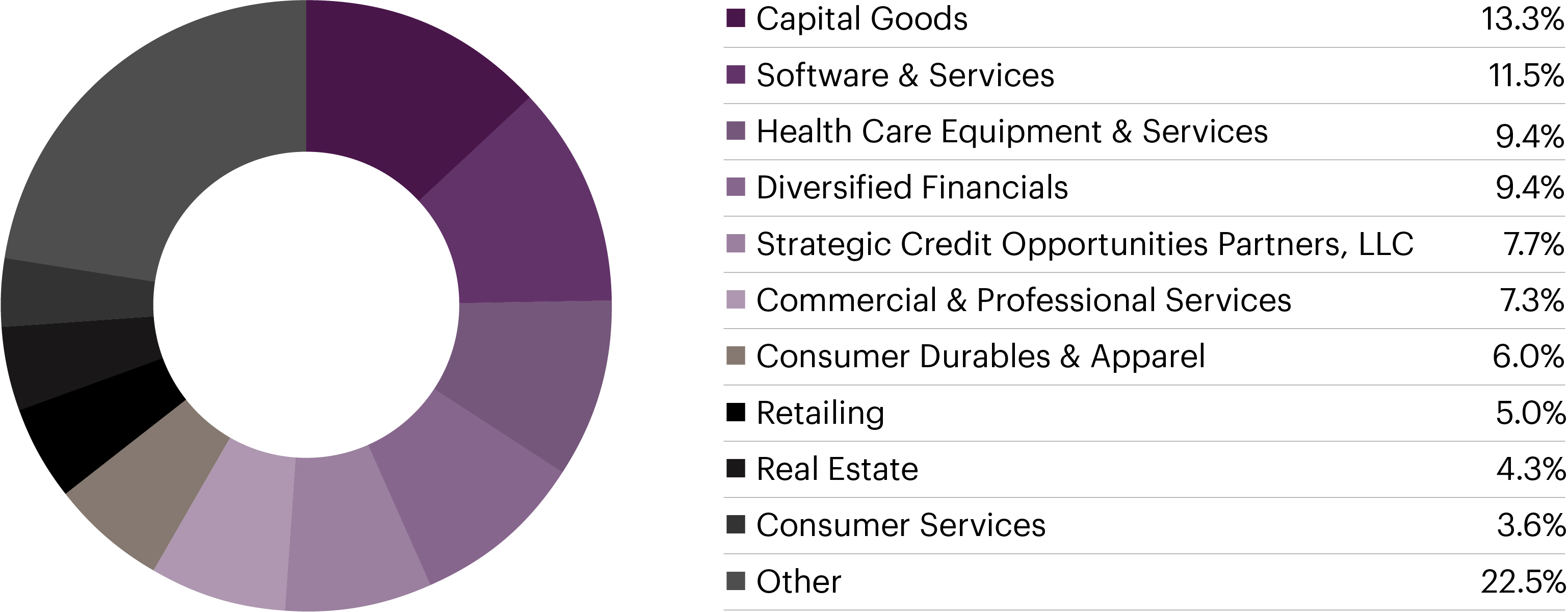

Sector exposure across top 10 industries